does nj offer 529 tax deduction

College savings plans fall under Internal Revenue Code Section 529 Qualified Tuition Programs. In New Mexico families can.

New Jersey Provides Tax Deduction For College Savings Plan Contributions

Tax Deductions for New Jersey Families Unlike traditional IRAs and 401ks 529 plan contributions are not tax deductible at the federal level.

. Njbest 529 college savings plan. Thanks to recent legislation. A 529 plan is designed to help save for college.

If you earn less than 20000 per year you are eligible for a tax deduction for contributions of up to 10000. Depending on where you live or where you started your 529 plan you could be eligible for one of these benefits. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan.

New Jersey does not offer a deduction for 529 plan contributions. Contributions to such plans are not deductible but the money grows tax-free while it remains. Unfortunately New Jersey does not offer any tax benefits for socking away funds in a 529.

Unlike many states the IRS does not provide a current tax deduction for. New Jersey does not provide any tax benefits for 529 contributions. As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of.

New Jerseys plan doesnt offer much. But if you live in New York and pay New York state income taxes you may be able to deduct the contributions. The NJBEST Scholarship is provided by the New Jersey.

Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. 5000 single 10000 joint.

For example new york residents are eligible for an annual state income tax deduction for 529 plan contributions up to 5000 10000 if married. If you choose to provide a testimonial you agree to give Franklin Templeton permission to use your story on our public website. As of January 2019 there are no tax deduction benefits when making a contribution to a 529.

5 tax credit on contributions of up to 2040 single 4080 joint beneficiary maximum credit of 102 single 204 10 tax credit on up to 2500 single. This feature starts in 2022. Section 529 - Qualified Tuition Plans.

The plan NJBEST is offered through Franklin Templeton. New Jersey 529 tax deduction.

Clueless About 529 Plans Here S A Guide Nj Com

New Jersey Income Tax Calculator Smartasset

How Much Can You Contribute To A 529 Plan In 2022

Hawaii 529 Plans Learn The Basics Get 30 Free For College Savings

New Jersey 529 Plan And College Savings Options Njbest

Direct Portfolio College Savings Plan Colorado 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Can I Use A N Y 529 Plan Even Though I Live In N J Njmoneyhelp Com

529 Tax Benefits The Education Plan

States That Offer 529 Plan Tax Deductions Bankrate

Saving For College 529 Plans Versus Everything Else

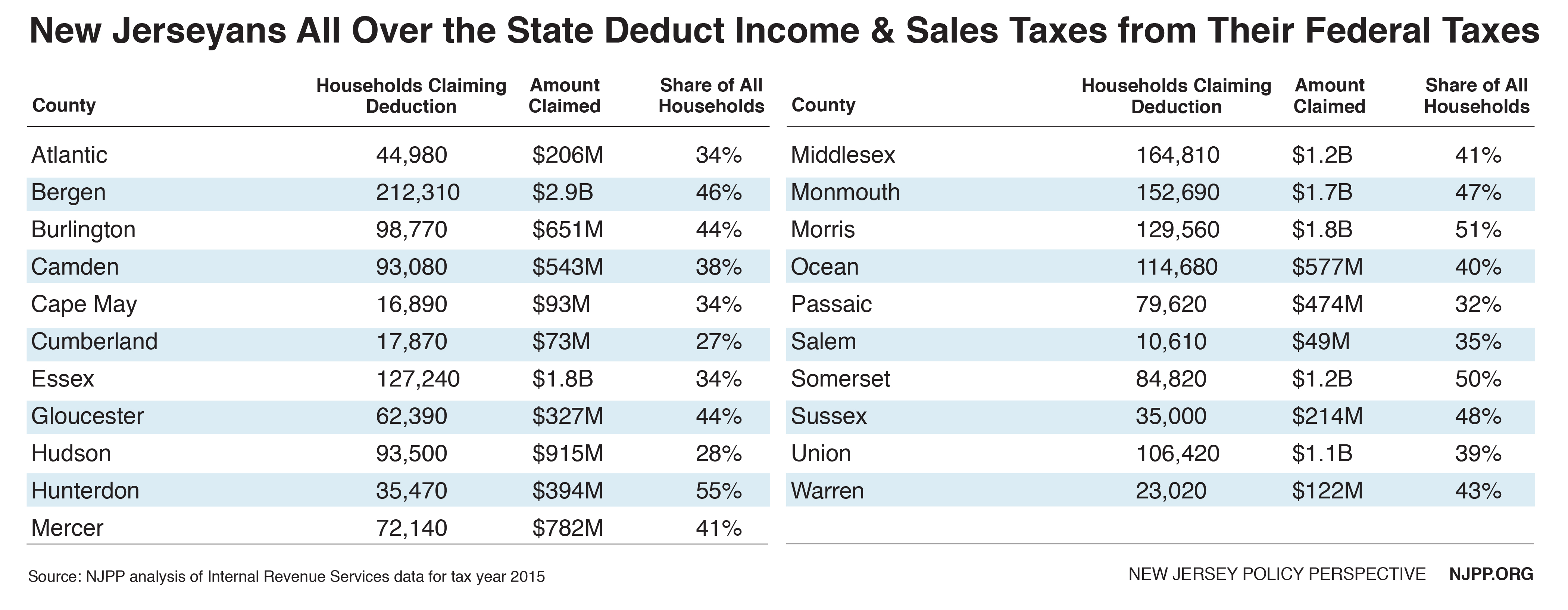

Millions Of New Jerseyans Deduct Billions In State And Local Taxes Each Year New Jersey Policy Perspective

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

Kansas 529 Plans Learn The Basics Get 30 Free For College Savings

Faq Minnesota College Savings Plan

How To Make Or Ask For A 529 Plan Gift Contribution Forbes Advisor

Parents Do You Have The Best 529 College Savings Plan Yes You Can Choose The Washington Post

529 State Tax Calculator Schwab 529 Savings Plan Charles Schwab